HOW THE 2016 PRESIDENTIAL ELECTION COULD IMPACT HEALTHCARE

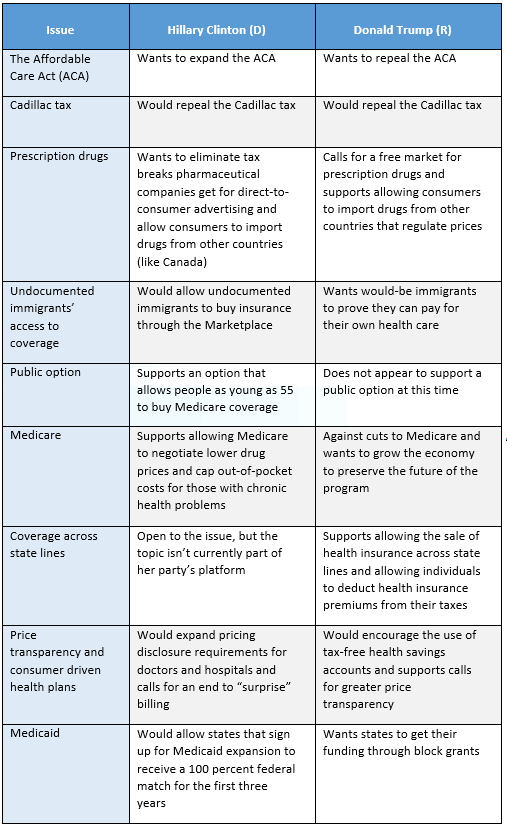

The 2016 presidential election could bring significant changes to the U.S. health care system. Hillary Clinton and Donald Trump have both campaigned on promises to control health care spending and reduce out-of-pocket expenses for consumers.

The chart below provides a brief overview of each candidate’s health care platform, so you can better understand how Clinton or Trump may affect the employee benefits landscape if elected into office.

©2016 ZYWAVE, INC. ALL RIGHTS RESERVED.

Emergency Room or Urgent Care?

If you’re faced with a sudden illness or injury, choosing where to seek medical attention can be crucial to your personal and financial well-being. Listed below is a guide to selecting the appropriate place of care.

You should visit the Emergency Room (ER) for the following conditions:

- Compound fractures

- Moderate to severe burns

- Uncontrollable bleeding

- Deep knife or gunshot wounds

- Serious head, neck or back injuries

- Seizures or lack of consciousness

- Signs of a heart attack or stroke

- Severe abdominal pain

- Poisoning

You should visit an Urgent Care Center for the following conditions:

- Sprains or strains

- Skin rashes and infections

- Ear infections

- Sore throat, fever or cough

- Flu symptoms

- Minor broken bones (toes, fingers, etc.)

- Vomiting, diarrhea or dehydration

- Diagnostic Services

*Please note that emergency rooms are equipped to handle life-threatening injuries and other serious conditions. Although urgent care centers are usually more cost effective, they are not substitutes for emergency care.

This is for informational purposes only and should not be interpreted as medical advice.

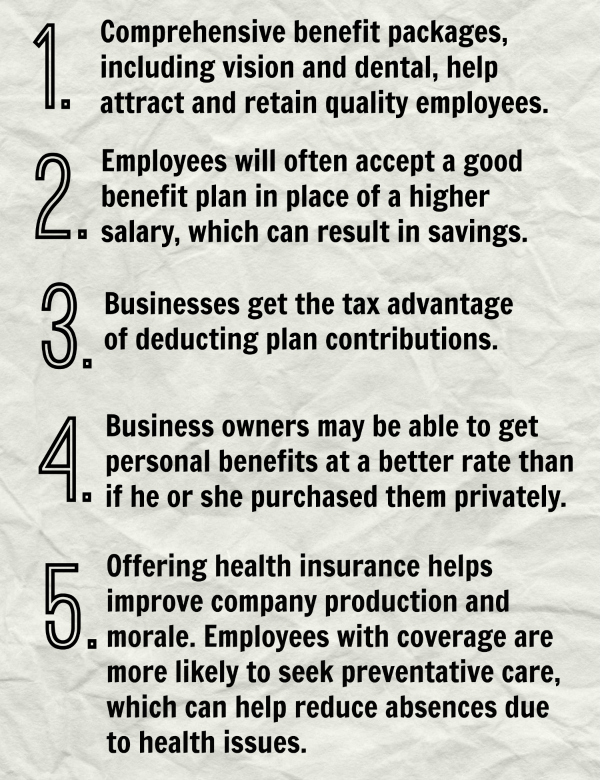

5 BIG Reasons to Offer Employee Benefits

Significant Changes to Form 5500

On July 21, 2016, a proposed rule was published by federal regulators that seeks to modernize and improve the Form 5500 annual return/report that is filed by employee benefit plans. The changes are expected to apply for plan years beginning on or after January 1, 2019.

While the Form 5500 is periodically updated so that it stays current with legal and market developments, these proposed updates are significant because of their focus on group health plans. Significantly, the proposed rule would eliminate the current filing exemption for small group health plans and require group health plans to complete a new detailed schedule.

In addition to these changes, the proposed changed would expand the Form 5500’s financial and compliance reporting, analytics capability and service provider information.

What Steps Should I Take?

Employers should monitor these proposed changes to the Form 5500 and consider how the changes would effect them if they are finalized. Employers with small group health plans that have been exempt from the Form 5500 filing requirement may wish to contact service providers to evaluate their options for Form 5500 filings.

DOL Increases Penalties for Health Plan Violations

On July 1st, 2016, the Department of Labor (DOL) issued an interim final rule that increases the civil penalty amounts that may be imposed under various federal laws, including the Employee Retirement Income Security Act (ERISA). The interim final rule increases the civil penalty amounts associated with:

- Failing to provide an annual Form 5500 (as applicable)

- Failing to provide the annual notice regarding premium assistance under the Children’s Health Insurance Program (CHIP)

- Failing to provide the Summary of Benefits and Coverage (SBC) as required by the Affordable Care Act (ACA)

The increased amounts apply to civil penalties that are assessed after August 1, 2016, for violations that occurred after November 2, 2015.

TAKE ACTION

Employers should review their health plans to ensure compliance with ERISA’s requirements. For example, employers should comply with ERISA’s reporting and disclosure rules, including the Form 5500, annual CHIP notice and SBC requirements.

CHECK OUT OUR NEW COMPANY WEBSITE

FLSA Overtime Rule Change

On May 18, 2016 the Department of Labor (DOL) released a new rule overhauling overtime wage payment in the United States. Under the new rule, the salary threshold will increase from $23,660 to $47,476 per year. It also increases the salary threshold for highly compensated individuals from $100,000 to $134,004 per year.

This new rule could affect more than 4 million American workers. According to estimates from the DOL, employers will spend more than $592 million to comply with the new rule. Employers who fail to implement overtime changes could face lawsuits, criminal charges, fines and restrictions in commerce.

WHEN MUST I COMPLY TO THIS RULE CHANGE?

Employers have until December 1, 2016 to comply, however, delaying preparation efforts could result in costly penalties. For more information on the new overtime rule, contact us today.

Do you know what the benefits of having a broker are?

We offer a wide array of benefit packages from medical, dental, and vision to supplemental benefits such as accident, cancer and life insurance. We work with a multitude of providers that make working with Employee Benefits Advisors, Inc. the best choice. In addition to our own talented professionals we have a wealth of resources available that make working with us practical and effective. We will work with you to develop a customized strategic plan that defines objectives and steps you will need to execute your benefits plan effectively. Our specialized team will evaluate quotes and make sure you are receiving the best possible options. Our services ensure an organized and thorough approach to fulfilling your benefits needs.

Our team has over 40 years of combined experience and we pride ourselves on the level of knowledge and service that we bring to our clients. We strive to show our dedication and commitment to excellence in our services to the business community not only in Oklahoma but in several other states as well. We provide our clients with legislative briefs, employee communication materials, and benefits administration tools. Our agency offers up-to-date, easy-to-understand comprehensive health care reform information to help both employers and employees understand the law and its implications. Our Legislative Brief publications summarize recent federal legislative developments in insurance and employee benefits, to help our clients understand laws including COBRA, HIPAA, and FMLA.

Another great product that we offer is MyWave Connect. Our clients receive access to a personalized website where they choose what updates they see as well as have the ability to search a variety of topics. The site offers resources to help with plan administration, legislative compliance, employee communication and more. We can assist you with all phases of employee communication, from employee meetings to payroll stuffers to informative brochures about employee benefits and wellness. We have experienced and highly knowledgeable insurance professionals who are ready to help you with this growing and important area of employee benefits. We focus on enriching your benefits package whether it’s through core or voluntary benefits!

Employee Benefit Advisors, Inc. – Helping you Navigate the World of Benefits.

What if the unexpected happens?

Can you afford to be out of work for an extended period of time, in addition to the medical bills that come with a serious illness or injury? Employee Benefit Advisors, Inc. can offer you peace of mind by helping you find short- and long-term disability coverage options for you and your employees.

Did you know?

• Over 36 million Americans are classified as disabled.

• Disabilities affect one-fifth of Americans (over 60 million people).

• Almost one-third of Americans entering the workforce today will become disabled before retiring.

• More than 25 percent of today’s 20-year-olds will become disabled before retirement.

• One in eight workers will be disabled for five or more years during their working careers.

• The average long-term disability absence lasts 2.6 years.

What may cause a disability?

• Illness

• Heart attack

• Pregnancy

• Cancer

• Mental disorders

• Accidents or injuries

Less than 10 percent of disabling injuries and illnesses are work-related: The other 90 percent are not, meaning workers’ compensation will not cover them.

Your biggest asset is your ability to work and earn a living. If you become disabled, your ability to earn a living is severely diminished.

If you were disabled, how would you pay for your home, your monthly bills, your children’s education? Did you know that one in every two home mortgage foreclosures are due to disability, not death?

What types of disability are available?

Short-term Disability (STD) is a type of disability insurance coverage that can help you remain financially stable should you become injured or ill and cannot work. Usually, STD coverage begins within one to 15 days of the event causing your disability. Short term disability coverage allows you to continue to receive pay at a fixed weekly amount, usually up to 60% of your average weekly earnings. This type of disability coverage usually lasts for 3 months or less.

Long-term Disability Insurance (LTD)

Long-term Disability (LTD) is a type of disability insurance coverage that pays employees a set percentage, usually 60%, of their average income after a specified elimination (waiting) period. Most LTD coverage has an elimination period of 3 months, but some coverages may have differing elimination periods. The length of LTD plans varies; some may be limited to a period between two and 10 years, while other plans continue paying out until age 65.

LTD insurance protects workers in the event they become disabled for a prolonged period prior to retirement. LTD policies are often offered through employers as part of their benefits package.

STD and LTD benefits can both be offered on a voluntary or involuntary basis. This means that employees can elect to take the coverage and pay the premium through payroll deduction or employers can cover these premiums for their employees.

If you have any questions regarding disability insurance don’t hesitate to give us a call at (405) 310 2040!

When you set up a retirement account, one of the first decisions you face is whether to have a traditional plan or a Roth plan. The difference between traditional plans and Roth plans comes down to how your earnings are taxed.

With a traditional plan, money you deposit into your account can be deducted from your taxable income for the year. This can be a significant cost-saving measure if the amount you deduct places you in a lower tax bracket. When you withdraw money from your account, taxes will be assessed on it.

Contributions to Roth plans, on the other hand, are not deducted from your taxable income—they are made with money that has already been taxed. After you retire, withdrawals from Roth accounts will not be taxed.